littleton co sales and use tax

THIS DOCUMENT THEN SIGN AND. DR 1485 - County Lodging Tax Return.

City Logos Logo Use Policy Littleton Co

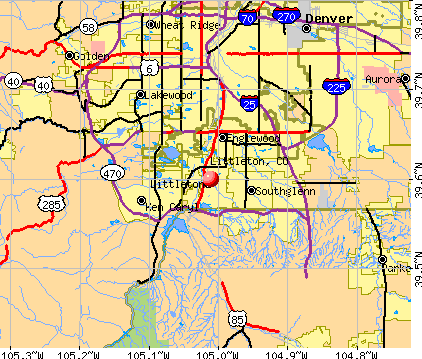

In Littleton in Arapahoe County Colorado 80120 the location GPS coordinates are.

. The City of Thornton Revenue Division collects sales tax use tax lodging tax telephone tax E-911 fees franchise fees PEG fees and pawnbroker surcharge fees. DR 1490 - Local Marketing District Tax Return. You can print a 8 sales tax table here.

Governor Polis signed HB22-1027 on January 31 2022 which extends the small business exception to destination sourcing requirements. 29 lower than the maximum sales tax in CO The 8 sales tax rate in Littleton consists of 29 Colorado state sales tax 025 Arapahoe County sales tax 375 Littleton tax and 11 Special tax. To access the system Click on Login.

Colorado CO Sales Tax Rates by City A The state sales tax rate in Coloradois 2900. To make a payment you will need a Littleton SalesUse Tax account number customer ID number as well as a computer-generated PIN. Superiors current sales tax rate is 346 of the retail purchase price of the tangible personal property or taxable services being purchased sold leased rented or otherwise consumed.

For SalesUse Tax payments the city uses a secure online website which provides 24-hour access and payment via credit card or electronic check. More details about Littleton Sales Use Tax Info According to our records this business is located at 2255 W Berry Ave. 4 State Sales tax is 290.

Participate in property and salesuse tax planning and research and the implementation of regulatory changes. 396180171 latitude -1050136346 longitude. The sales tax jurisdiction name is Littleton Arapahoe Co which may refer to a local government division.

The Colorado use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Colorado from a state with a lower sales tax rate. For more information and assistance call the Littleton Revenue and Sales Tax Division at 303-795. This is the total of state county and city sales tax rates.

It also contains contact information for all self-collected jurisdictions. This Website allows you 24-hour access to sales tax returns and sales tax payments. However the Department does not administer and collect sales taxes imposed by certain home-rule cities that instead administer their own sales taxes.

Denver CO 80202 Union Station area Temporarily Remote. Click on the Login tab. Apply to Customer Service Representative Auditor Tax Manager and more.

You will need your City of Littleton SalesUse Tax Account Number Customer ID Number as well as your PIN Password. Littleton Sales Tax Rates for 2022 Littleton in Colorado has a tax rate of 725 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Littleton totaling 435. To use the City of Littletons online sales tax filing system you must first have your ID Number Account Number and Password PIN.

Littleton is in the following zip codes. The Colorado sales tax rate is currently 29. If your business is located in a self-collected jurisdiction you must apply for a.

This tax is equal to 25 cents on every 100 spent. Enter your Customer ID Account Number and Password PIN and select Login. Once you have this information you may log in.

8 rows Littleton voters approved a 075 sales and use tax rate increase in November 2021 to fund. To be compliant with tax laws you must report and pay consumer use tax when sales tax is not collected by the seller on a taxable product. This exception applies only to businesses with less than 100000 in retail sales.

There are a total of 223 local tax jurisdictions across the state collecting an average local tax of 3419. You can find more tax rates and allowances for Littleton and Colorado in the 2022 Colorado Tax Tables. BERRY AVENUE LITTLETON CO 80120.

These funds are essential to providing services that make the city a vital business and family-friendly place to live. Destination Sourcing Deadline Extended. NewProperty Sales Tax Analyst I- Denver CO.

Click here for a larger sales tax map or here for a. Sales Tax Breakdown Littleton Details Littleton CO is in Arapahoe County. You will be prompted to enter an e-mail.

DR 1002 - Colorado Sales and Use Tax Rates. 80120 80121 80122. Beginning October 1 2022 all retailers will be required to apply the destination sourcing.

The County sales tax rate is 025. Including local taxes the Colorado use tax can be as high as 7100. CLICK THE ABOVE BUTTON TO PRINT.

In Colorado this companion tax is called Consumer Use Tax. BERRY AVENUE LITTLETON CO 80120 COVERED 303-795-3768 DATE DUTE COMPANY NAME CITY STATE ZIP CODE. Estimated Combined Tax Rate 675 Estimated County Tax Rate 025 Estimated City Tax Rate 250 Estimated Special Tax Rate 110 and Vendor Discount 40 N.

This requirement applies to purchases made by both individual consumers and businesses in Colorado. Sales Tax and Use Tax Rate of Zip Code 80122 is located in Littleton City Arapahoe County Colorado State. Reconciles tax bills and GL accounts prepares tax.

The minimum combined 2022 sales tax rate for Littleton Colorado is 8. This document lists the sales and use tax rates for all Colorado cities counties and special districts. 6319 Colorado has state sales tax of 29 and allows local governments to collect a local option sales tax of up to 8.

With local taxes the total sales tax rate is between 2900 and 11200. 7 an ordinance of the city of littleton 8 colorado amending section 3-9-1-2 and adding 9 section 3-9-1-8 of thelittletonmunicipalcode 10 regarding economic nexus and the 11 obligation of remote sellers to collect and 12 remit sales tax 13 14 whereas the. The current total local sales tax rate in Littleton CO is 4250.

In 2003 the electors of Arapahoe County voted to approve a resolution imposing a 025 County Open Space Sales and Use Tax on the sale of tangible personal property at retail and the furnishings of certain services within the County. The Colorado Department of Revenue administers not only state sales tax but also the sales taxes imposed by a number of cities counties and special districts in Colorado. Each separate and distinct sale is considered a taxable transaction.

The December 2020 total local sales tax rate was 7250. Colorado has recent rate changesFri Jan 01 2021. SALESUSE TAX RETURN PERIOD 2255 W.

The Littleton sales tax rate is 375. Sales tax is legally charged at the point of sale-which is where ownership changes. 50000 - 71333 a year.

The Colorado use tax rate is 29 the same as the regular Colorado sales tax. Littleton Sales Use Tax Info is categorized under Budget Agency Government SIC code 9311. Sales Tax Calculator Sales Tax Table.

Welcome to the City of Littleton Business SalesUse Tax E-Government Website. M D YYYY.

Littleton Colorado Co 80120 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Business Sales Use Tax License Littleton Co

Littleton Co Commercial Appraiser Appraisal Services Colorado Appraisal Consultants

Council District Map Littleton Co

Moving To Littleton Co 2022 Is Living In Littleton Co Right For You

Council District Map Littleton Co

Sales Use Tax Payments Littleton Co

Littleton Colorado Co 80120 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Trails In Littleton Littleton Co

Business Directory Littleton Co

City Logos Logo Use Policy Littleton Co

Origins Of Littleton Street Names Littleton Co

Guide To Fireworks In Littleton City News Littleton Co